Smarter Lending That Keeps Clients Coming Back to You.

Competitive private money loans that work for your client and keep your deals coming.

Our History of Broker-Friendly Lending

Let’s Get Your Client Funded

Our experienced team is here to help your client save time and money. As the funding decision makers, we create tailored solutions to ensure success for our real estate investors.

At CSL, our lending relationships are our priority. Our competitively priced bespoke loans keep real estate investors coming back thanks to our experienced team, lack of hidden fees, transparent communication, and quick results for your client.

Your clients trust you, and we respect that. When you work with us, your relationships are always protected. Share your scenarios, and we’ll find smart loan solutions that make sense for your clients.

We value long-term relationships with our broker partners—a commitment to transparent communication and no hidden surprises. Use our experienced team to your advantage with an initial assessment while receiving feedback about your client’s opportunities and lending options.

Provide us with (minimal) necessary documentation and property information so we can begin the loan process.

Lending our own money means no investor delays. We’ll take it from here and contact you or your client every step of the way to ensure a smooth closing.

Our Loan Programs for Brokers

By lending our own money we deliver flexibility, direct communication, and quick results where others can’t. We’ll help you find the right loan option for your clients.

Fix & Flip Loans

Exclusively for non-owner-occupied residential real estate properties that are rehabbed and sold or held and rented.

- 6–24 Month Loan Terms

- $150k Minimum Loan Amount

- Up to 95% LTC

- 650 Minimum FICO

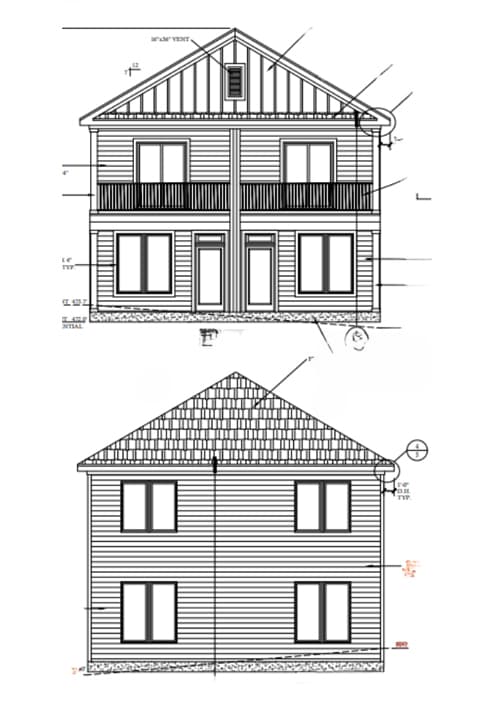

Ground-Up Construction Loans

Our ground-up financing is individually structured to provide flexible funding, regardless of the size of your property.

- 6–24 Month Loan Terms

- $150k Minimum Loan Amount

- Up to 85% LTC

- 680 Minimum FICO

Bridge Loans

Don’t miss an investment opportunity with our bridge loans that allow you to close ASAP.

- 12 Month Loan Terms

- $150k Minimum Loan Amount

- Up to 75% LTV on Purchase

- Up to 93% LTC

- 650 Minimum FICO

Short-Term Rental Property Loans

Perfect for Airbnb, VRBO or rental property owners who want to take advantage of fixed rates for purchasing or refinancing.

- 6–24 Month Loan Terms

- $150k Minimum Loan Amount

- Up to 60% Cash Out

- 650 Minimum FICO

DCSR Rental Loans

Our Debt Service Coverage Ratio (DSCR) loans are for rental property owners looking for a 30-year refinancing option.

- 30 Year Loan Terms

- $100k Minimum Loan Amount

- Up to 80% LTC/LTV

- 640 Minimum FICO

Why CSL Fix & Flip Loans Are Different

Our team of in-house expert fix-and-flip hard money lenders is here to provide tailored financial solutions for real estate developers and residential investors without the time lag or cookie-cutter funding.

Our commitment to clear communication and customer success ensures a seamless borrowing experience with less unnecessary paperwork for you.

With no hidden fees, transparent communication, and reliable results, CSL has your back for all your fix-and-flip funding.

Your Clients. Our Lending. Shared Success.

Brokers nationwide partner with CSL to deliver funding solutions that win deals and build repeat business.

Read some of our reviews.